How Does Zomato Make Money

History

Zomato was founded in 2008 by Dipender Goel, along with his colleague Pankaj Chadha.

So these guys graduated from IIT Delhi and started their careers as management consultants in Bain & company. And during this time they came across a very interesting business idea.

So both of these guys were big foodies. They used to visit different restaurants, but they always struggled to find the restaurant’s menus, right so they always have to either call the restaurants or they had to ask their friends and colleagues about the menu options at any particular restaurant. Therefore they thought, why not build a website where people can find these restaurants, menus online, and people can also write reviews about the restaurants and other people can benefit from the reviews that have been written by others.

So they were so convinced about this business idea that they left their well-paying corporate jobs and started a restaurant listing website called foodie bay. And of course, the idea was very good and the website became very popular very quickly and restaurants started approaching these guys to put out their names in the search results.

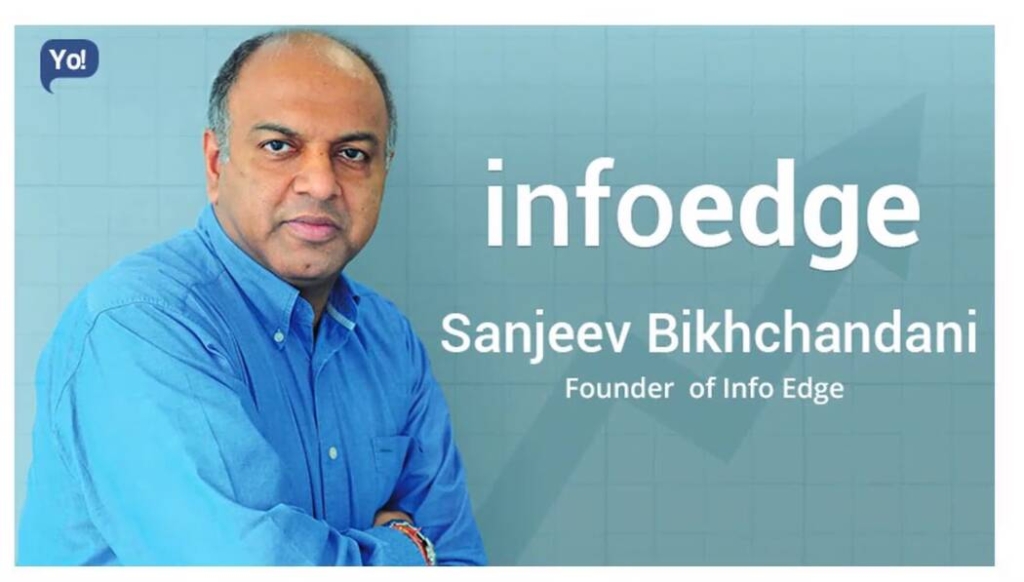

So from this point onwards, the business started booming, but the turning point in the journey came when a veteran investor, Sanjeev Mirchandani from Info Edge invested in their company. Info Edge for those of you who don’t know, owns popular portals, such as naukri.com 99, acres, jeevansathi.com, and policy Bazaar.

So Sanjeev mentored the young team, rebranded the company from foodie bay to Zomato, and set them off on an aggressive expansion path and now from 2008 till 2015, the company’s focus was on the advertising business, right and they perform spectacularly. Then in 2015, they ventured into the food delivery business.

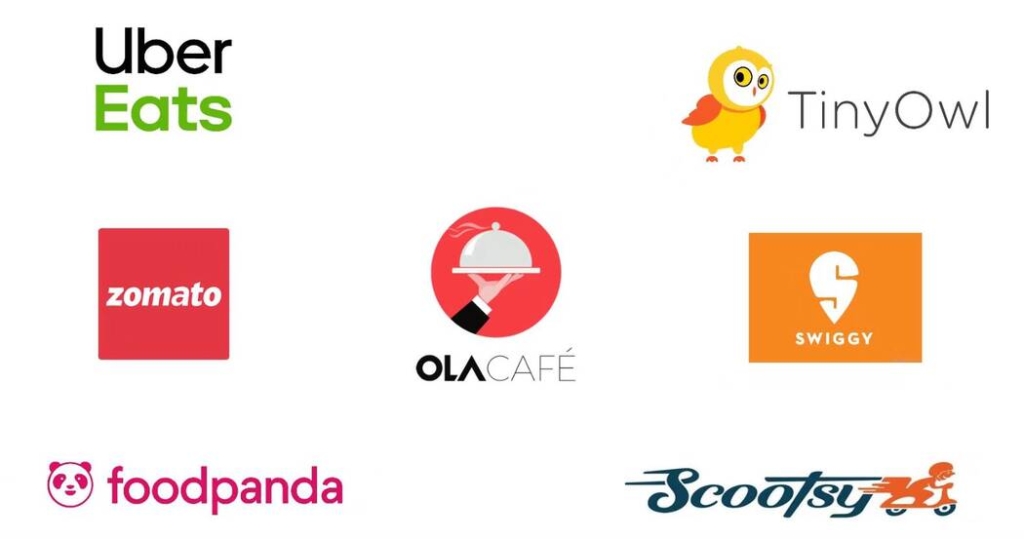

Now you probably won’t remember this, but back in 2015, the food delivery business was a very crowded space, right? So there were so many different players who were operating in India. It was almost like hunger games and all these contestants, they were trying to survive and win, but as it happens in hunger games that most of these contestants did not survive even the big ones like Uber eats had to shut down their operations.

So after several years of this war, Zomato and Swiggy survived this game and came out victorious by using some very smart, innovative, and sometimes even aggressive strategies and Zomato in particular, not only survived this game but also expanded very quickly in the international markets and now it has a presence in 24 countries. Now let’s talk about the business model of Zomato.

How does Zomato make money?

Well, Zomato makes money from these four lines of business. Let’s start with food delivery. Food delivery-based businesses, the bread, and butter of the Zomato because 85% of revenue comes from this segment. Now the business model here is very straightforward.

So you go to Zomato’s app, look for all the restaurants nearby who are willing to deliver Paneer Tikka Masala, and based on the reviews and based on your search results, you place the order on Zomato’s app. Now Zomato takes your order and sends that order to the restaurant. As soon as the food is ready, Zomato’s delivery guys will pick up the food from the restaurant and deliver you right at your home. Now, in this process, let’s say you paid 500 bucks, right? 400 rupees for the food, and let’s say 50 rupees for delivery and 50 rupees for packaging. Now that delivery and packaging charges are passed through the matter. It doesn’t make any money from it right they just pass it down to the delivery guys and the restaurants respectively now out of this 400 rupees Zomato will charge a commission to the restaurant.

So in this case, let’s say 25%, so out of these 400 rupees Zomato will keep 100 rupees and the restaurant gets 300 rupees. So that is how typically a delivery-based business works. But what people don’t realize is that Zomato has an additional revenue stream in this equation. And that revenue source comes when restaurants pay Zomato to show up their restaurant listing in this search and that’s a very significant portion of Zomato’s revenue. Now, the second source of income for Zomato is dine-out advertising. So in the first source, Zomato was making money from people who wanted to eat at home. Now in this second source, Zomato’s making money from people who want to eat in restaurants, right?

Because people who want to eat out, rely heavily on Zomato’s website or app to find the perfect restaurants. So they use Zomato to search and discover restaurants, read reviews, write reviews, right? upload photos, book a table, make payment while dining out.

So there are so many different ways people who want to eat out, they use Zomato services now because Zomato is such a popular source for people who want to dine out. The restaurants know that if they don’t show up at the top of the search results, they will lose the business. So therefore restaurants pay the Zomato to come on the top of the search results and get visibility from people who are looking for those kinds of dining options.

Now, the third source of revenue for Zomato is hyperpure. So through hyperpure Zomato is basically acting as a middle man between the farmers and the restaurants, right? So Zomato sources, ingredients, and supplies from the farmers and the bill and sell them to the restaurants and the restaurants that are ordering supply through hyperpure. They get a hyperpure insight tag on their Zomato page, which is basically intended to provide the assurance of quality and that gives comfort to the customers.

So Zomato started the hyperpure in 2019, and they have been growing very rapidly. And just to give you guys a sense in the month of December 2020, this applied to over 6,000 restaurants and across six cities in India.

Now the fourth source of income from Zomato is their paid membership program called Zomato pro. So as you guys know that regular restaurant goes, they are always hunting for discounts and they like subscriptions like Zomato pro through which they get flat percentage discounts at certain restaurants, both on food delivery as well as on dining out offerings.

Competition

Now let’s talk about that competition. Now, the most obvious one is Swiggy. Now Swiggy and Zomato, have become synonymous with food delivery rates. Every time we think about food delivery, we think of, these two companies, and both of them have raised large sums of money to scale their business because the food delivery business is a numbers game.

If you want your business model to be financially viable, you have to serve a lot of customers because the margins here are less and the expenses are high. The only way you’re going to make money is when you have more customers. So on the face of it, the business model of Sweden, so matter, Swiggy and Zomato they look very similar, but in spite of these commonalities, there are some key differences in the direction in which these companies want to go. Now, Swiggy is focusing on delivery.

So what they are saying is that we are users who use to deliver anything you want. It can be food, it can be groceries or it can be medicine. Zomato on the other hand is focusing on food, right? So they are saying that we are a food company, so they are developing new business models around food delivery, food consumption, and the food supply chain.

So as of now, these two companies are very similar, but in the coming years, if they stick to their vision, we will see some key differences that rising between these two companies. But the dark horse in this race is the new entrant Amazon now at this point of time, Amazon is just a new entrant in the food delivery business, and it is only doing operations in Bangalore, but in the coming months and years, it is definitely going to scale up its operations.

Now, if there is anyone company that knows how to enter into a country or a new segment and become a leader in it, that would be Amazon. And on top of that, Amazon has a very loyal customer base and it understands the business of delivery extremely well. Now let’s shift our focus back to the Zomato and do its

SWOT Analysis

So SWOT is a fancy term for strength, weakness, opportunities, and threats.

Strengths

The first one is very obvious with Zomato has established itself as a leader in the food delivery business.

There is no denying that, but the second thing, which is very important to understand. Zomato has also developed a very sophisticated technology infrastructure that helps it in identifying the key patterns in consumption and demand and which has become its cutting edge. So think of Zomato more as a technology company than a food delivery company.

Now Zomato’s third strength is that diversified revenue sources. So over the past several years, the Zomato has developed very solid revenue streams, not just from the commissions but also from delivery fees, from the membership fees, from the listing fees of the restaurant side. And of course, the revenue that comes from the advertising business. So even if let’s say there is some disruption in one of these revenue streams, there are enough revenue streams around to keep the company going.

Now, the next key strength for Zomato, which is actually very surprising is that Zomato is sitting on a lot of cash. So as of now, the company is setting on almost 5,000 crore rupees of cash and cash. equivalent side. And most of this cash is being parked by the company’s liquid mutual funds. So what it basically means, says Zomato has a strong balance sheet. It has almost zero debt. So that is a very strong point when it comes to Zomato’s financials.

Weaknesses

The number one weakness is that there is no customer loyalty in this line of business. Let’s if you want to order paneer tikka masala and the same paneer tikka masala can be delivered by Swiggy at a cheaper rate, you will not think twice logging into Swiggy and placing the order, right? So there is no reason for you to stick around with Zomato.

Now, the second weakness in Zomato as of now, is that a lot of customer acquisition was done using deep discounts, right? They were giving discounts of 30%, 35%, and 40%, but these kinds of discounts may not be sustainable. So they gave all these discounts to attract these people for installing that Zomato app on their phones. But for Zomato to be able to keep doing that, let’s say two years, three years, or five years online, it’s going to be very, very hard. It’s not sustainable.

The third weakness, which I don’t think a lot of people talk about is that Zomato has spread itself thin across many countries. So the international expansion, although it looks very good on paper, if you see the revenue contribution of all these countries that Zomato has expanded itself into it is very, very negligible. And in fact, Zomato had to close its operation in some of the countries and come out of them.

So this international expansion strategy is not going as well as they thought now, the last weakness, which I perceive it, but not necessarily be true is regarding the work culture The work culture of Zomato has come under attack recently, but because many employees have complained about the lack of diversity and inflexibility when it comes to working hours. So that is something that they need to work on.

Opportunities

Number one, the food delivery business in India is expected to see the highest growth in the coming years. So according to CLSA, the market size of the food delivery business is expected to increase to $11 billion by financial year, 2026.

The second opportunity, which is, I think very clear is that the growing population along with the increasing smartphone penetration is definitely going to help increase the customer base for Zomato. Last but not least. I’m sure a lot of you would have observed that there is a cultural change that is going on in India.

It’s a lot of people who’re eating food outside more often. And if you compare this with, let’s say, you know, 15 years back or 20 years. That was not the case. People use to prefer eating at home. So this cultural change of eating food from outside is definitely going to help us Zomato as well.

Threats

No 1 threat is Swiggy of course, right?

This is the most obvious one, but that’s not the only threat. What is unknown for Zomato as of now is Amazon, right? Amazon is yet to show its cards and increasing competition from Amazon will definitely lead to another prolonged period of cash burn. And as I mentioned earlier, when Amazon starts to go after one line, of business it is going to burn a lot of cash and it is going to put a lot of pressure on its competitors.

Now, the third threat, which is coming for both Zomato and Swiggy, is that the restaurants are actually pushing back on higher commissions. So if the recent cases are any indication, then we can see that Zomato will see some kind of a push back from these restaurants, and probably they will not be able to generate more commissions by increasing their margins.

And last but not least, there is a rise of smaller regional delivery services known as hyper-local services. They can also pose a risk for Zomato. So one such example is cloud kitchen. So cloud kitchen is basically a concept where you don’t need infrastructure, like a restaurant. You can basically operate from your home and these cloud kitchens, which are operating at a very low cost they are collaborating with companies such as rebel foods to deliver food at a much cheaper price. So guys that were our SWOT analysis.

Now let’s talk about IPO.

So through this IPO, the company is planning to raise 9,375 crore rupees, and 9,000 crore rupees, which is going to be a fresh issue. and 375 crores will be offered this proportion is actually very good because the company intends to use these funds primarily for its organic growth or inorganic growth plans.

And I always like to invest in companies that want to use my money for expansion rather than settling their loans, but let’s just, you know, dig deeper and look at the financials. So we’ll start with the balance sheet.

Now, Zomato definitely has a beautiful balance sheet. And the reason I say this is because Zomato has very little or no borrowings at all and that is a very positive point when it comes to the balance sheet. Now, the income statement is equally impressive after the growth of independents have been consistent in spite of some of the hiccups that they saw during the COVID crisis.

But for all of you considering investing, in Zomato Let’s understand a very simple fact first. So in spite of all the good things that we have talked about so far, Zomato is still a loss-making company.

Now that sounds bad. Right?

Why would anyone invest in a company which is loss-making? Well, there is a very good reason for investing in a company, even if it’s loss-making and a perfect example for that will be Reliance Jio remember how Mukesh Ambani stormed the telecom sector with ultra-cheap data plans and basically kicked most of the players out of the market.

And once these guys fell out of the market Jio, steadily, raise its prices. Right? So exactly the same game is being played by Zomato and Swiggy. Right, because they had to first establish themselves as little in the sector and kick all that competition out. And now they’re, they’re in power. They have the ability to charge higher commissions and hopefully stay profitable for years and decades to come now with all that analysis now comes to the million-dollar question that will I be subscribing to this IPO?

So, guys, I like this company. I like this industry food delivery is here to stay. And in this market, Zomato has a sizable presence with strong brand recognition. And in fact, that even the average order value that Zomato has been receiving is on a rise, which is a very positive indication. So I would like to invest in this company.

Yes, but my main objection is the valuation. Zomato is not like a regular company where I can just use the profits to come up with a fair evaluation, the valuation of a company, which is in a pre-profit stage is done based on a lot of assumptions. And I’m not comfortable taking that leap of faith. The second thing is that I’m concerned about Amazon because we have seen in the past how damaging Amazon can be for the existing players in any sector.

So in the years to come, we don’t know how much damage can Amazon cost to Zomato. So to put it simply I’m willing to invest in Zomato But I’m willing to wait for it to get listed, even if I have to pay a premium, but I need some more clarity about the competition from Amazon. So, guys, this is it. I just wanted to share my understanding of the business of Zomato.

And I hope that you found something useful from this analysis.

How Does Zomato Make Money

History

Zomato was founded in 2008 by Dipender Goel, along with his colleague Pankaj Chadha.

So these guys graduated from IIT Delhi and started their careers as management consultants in Bain & company. And during this time they came across a very interesting business idea.

So both of these guys were big foodies. They used to visit different restaurants, but they always struggled to find the restaurant’s menus, right so they always have to either call the restaurants or they had to ask their friends and colleagues about the menu options at any particular restaurant. Therefore they thought, why not build a website where people can find these restaurants, menus online, and people can also write reviews about the restaurants and other people can benefit from the reviews that have been written by others.

So they were so convinced about this business idea that they left their well-paying corporate jobs and started a restaurant listing website called foodie bay. And of course, the idea was very good and the website became very popular very quickly and restaurants started approaching these guys to put out their names in the search results.

So from this point onwards, the business started booming, but the turning point in the journey came when a veteran investor, Sanjeev Mirchandani from Info Edge invested in their company. Info Edge for those of you who don’t know, owns popular portals, such as naukri.com 99, acres, jeevansathi.com, and policy Bazaar.

So Sanjeev mentored the young team, rebranded the company from foodie bay to Zomato, and set them off on an aggressive expansion path and now from 2008 till 2015, the company’s focus was on the advertising business, right and they perform spectacularly. Then in 2015, they ventured into the food delivery business.

Now you probably won’t remember this, but back in 2015, the food delivery business was a very crowded space, right? So there were so many different players who were operating in India. It was almost like hunger games and all these contestants, they were trying to survive and win, but as it happens in hunger games that most of these contestants did not survive even the big ones like Uber eats had to shut down their operations.

So after several years of this war, Zomato and Swiggy survived this game and came out victorious by using some very smart, innovative, and sometimes even aggressive strategies and Zomato in particular, not only survived this game but also expanded very quickly in the international markets and now it has a presence in 24 countries. Now let’s talk about the business model of Zomato.

How does Zomato make money?

Well, Zomato makes money from these four lines of business. Let’s start with food delivery. Food delivery-based businesses, the bread, and butter of the Zomato because 85% of revenue comes from this segment. Now the business model here is very straightforward.

So you go to Zomato’s app, look for all the restaurants nearby who are willing to deliver Paneer Tikka Masala, and based on the reviews and based on your search results, you place the order on Zomato’s app. Now Zomato takes your order and sends that order to the restaurant. As soon as the food is ready, Zomato’s delivery guys will pick up the food from the restaurant and deliver you right at your home. Now, in this process, let’s say you paid 500 bucks, right? 400 rupees for the food, and let’s say 50 rupees for delivery and 50 rupees for packaging. Now that delivery and packaging charges are passed through the matter. It doesn’t make any money from it right they just pass it down to the delivery guys and the restaurants respectively now out of this 400 rupees Zomato will charge a commission to the restaurant.

So in this case, let’s say 25%, so out of these 400 rupees Zomato will keep 100 rupees and the restaurant gets 300 rupees. So that is how typically a delivery-based business works. But what people don’t realize is that Zomato has an additional revenue stream in this equation. And that revenue source comes when restaurants pay Zomato to show up their restaurant listing in this search and that’s a very significant portion of Zomato’s revenue. Now, the second source of income for Zomato is dine-out advertising. So in the first source, Zomato was making money from people who wanted to eat at home. Now in this second source, Zomato’s making money from people who want to eat in restaurants, right?

Because people who want to eat out, rely heavily on Zomato’s website or app to find the perfect restaurants. So they use Zomato to search and discover restaurants, read reviews, write reviews, right? upload photos, book a table, make payment while dining out.

So there are so many different ways people who want to eat out, they use Zomato services now because Zomato is such a popular source for people who want to dine out. The restaurants know that if they don’t show up at the top of the search results, they will lose the business. So therefore restaurants pay the Zomato to come on the top of the search results and get visibility from people who are looking for those kinds of dining options.

Now, the third source of revenue for Zomato is hyperpure. So through hyperpure Zomato is basically acting as a middle man between the farmers and the restaurants, right? So Zomato sources, ingredients, and supplies from the farmers and the bill and sell them to the restaurants and the restaurants that are ordering supply through hyperpure. They get a hyperpure insight tag on their Zomato page, which is basically intended to provide the assurance of quality and that gives comfort to the customers.

So Zomato started the hyperpure in 2019, and they have been growing very rapidly. And just to give you guys a sense in the month of December 2020, this applied to over 6,000 restaurants and across six cities in India.

Now the fourth source of income from Zomato is their paid membership program called Zomato pro. So as you guys know that regular restaurant goes, they are always hunting for discounts and they like subscriptions like Zomato pro through which they get flat percentage discounts at certain restaurants, both on food delivery as well as on dining out offerings.

Competition

Now let’s talk about that competition. Now, the most obvious one is Swiggy. Now Swiggy and Zomato, have become synonymous with food delivery rates. Every time we think about food delivery, we think of, these two companies and both of them have raised large sums of money to scale their business because the food delivery business is a numbers game.

If you want your business model to be financially viable, you have to serve a lot of customers because the margins here are less and the expenses are high. The only way you’re going to make money is when you have more customers. So on the face of it, the business model of Swiggy and Zomato look very similar, but in spite of these commonalities, there are some key differences in the direction in which these companies want to go. Now, Swiggy is focusing on delivery.

So what they are saying is that we are users who use to deliver anything you want. It can be food, it can be groceries or it can be medicine. Zomato on the other hand is focusing on food, right? So they are saying that we are a food company, so they are developing new business models around food delivery, food consumption, and the food supply chain.

So as of now, these two companies are very similar, but in the coming years, if they stick to their vision, we will see some key differences that rising between these two companies. But the dark horse in this race is the new entrant Amazon now at this point of time, Amazon is just a new entrant in the food delivery business, and it is only doing operations in Bangalore, but in the coming months and years, it is definitely going to scale up its operations.

Now, if there is anyone company that knows how to enter into a country or a new segment and become a leader in it, that would be Amazon. And on top of that, Amazon has a very loyal customer base and it understands the business of delivery extremely well. Now let’s shift our focus back to the Zomato and do its

SWOT Analysis

So SWOT is a fancy term for strength, weakness, opportunities, and threats.

Strengths

The first one is very obvious with Zomato has established itself as a leader in the food delivery business.

There is no denying that, but the second thing, which is very important to understand. Zomato has also developed a very sophisticated technology infrastructure that helps it in identifying the key patterns in consumption and demand and which has become its cutting edge. So think of Zomato more as a technology company than a food delivery company.

Now Zomato’s third strength is that diversified revenue sources. So over the past several years, the Zomato has developed very solid revenue streams, not just from the commissions but also from delivery fees, from the membership fees, from the listing fees of the restaurant side. And of course, the revenue that comes from the advertising business. So even if let’s say there is some disruption in one of these revenue streams, there are enough revenue streams around to keep the company going.

Now, the next key strength for Zomato, which is actually very surprising is that Zomato is sitting on a lot of cash. So as of now, the company is setting on almost 5,000 crore rupees of cash and cash. equivalent side. And most of this cash is being parked by the company’s liquid mutual funds. So what it basically means, says Zomato has a strong balance sheet. It has almost zero debt. So that is a very strong point when it comes to Zomato’s financials.

Weaknesses

The number one weakness is that there is no customer loyalty in this line of business. Let’s if you want to order paneer tikka masala and the same paneer tikka masala can be delivered by Swiggy at a cheaper rate, you will not think twice logging into Swiggy and placing the order, right? So there is no reason for you to stick around with Zomato.

Now, the second weakness in Zomato as of now, is that a lot of customer acquisition was done using deep discounts, right? They were giving discounts of 30%, 35%, and 40%, but these kinds of discounts may not be sustainable. So they gave all these discounts to attract these people for installing that Zomato app on their phones. But for Zomato to be able to keep doing that, let’s say two years, three years, or five years online, it’s going to be very, very hard. It’s not sustainable.

The third weakness, which I don’t think a lot of people talk about is that Zomato has spread itself thin across many countries. So the international expansion, although it looks very good on paper, if you see the revenue contribution of all these countries that Zomato has expanded itself into it is very, very negligible. And in fact, Zomato had to close its operation in some of the countries and come out of them.

So this international expansion strategy is not going as well as they thought now, the last weakness, which I perceive, but not necessarily be true is regarding the work culture. The work culture of Zomato has come under attack recently, but because many employees have complained about the lack of diversity and inflexibility when it comes to working hours. So that is something that they need to work on.

Opportunities

Number one, the food delivery business in India is expected to see the highest growth in the coming years. So according to CLSA, the market size of the food delivery business is expected to increase to $11 billion by financial year, 2026.

The second opportunity, which is, I think very clear is that the growing population along with the increasing smartphone penetration is definitely going to help increase the customer base for Zomato. Last but not least. I’m sure a lot of you would have observed that there is a cultural change that is going on in India.

It’s a lot of people who’re eating food outside more often. And if you compare this with, let’s say, you know, 15 years back or 20 years. That was not the case. People use to prefer eating at home. So this cultural change of eating food from outside is definitely going to help Zomato as well.

Threats

No 1 threat is Swiggy of course, right?

This is the most obvious one, but that’s not the only threat. What is unknown for Zomato as of now is Amazon, right? Amazon is yet to show its cards and increasing competition from Amazon will definitely lead to another prolonged period of cash burn. And as I mentioned earlier, when Amazon starts to go after one line of business it is going to burn a lot of cash and it is going to put a lot of pressure on its competitors.

Now, the third threat, which is coming for both Zomato and Swiggy, is that the restaurants are actually pushing back on higher commissions. So if the recent cases are any indication, then we can see that Zomato will see some kind of a push back from these restaurants, and probably they will not be able to generate more commissions by increasing their margins.

And last but not least, there is a rise of smaller regional delivery services known as hyper-local services. They can also pose a risk for Zomato. So one such example is cloud kitchen. So cloud kitchen is basically a concept where you don’t need infrastructure, like a restaurant. You can basically operate from your home and these cloud kitchens, which are operating at a very low cost are collaborating with companies such as rebel foods to deliver food at a much cheaper price. So guys that were our SWOT analysis.

Now let’s talk about IPO.

So through this IPO, the company is planning to raise 9,375 crore rupees, and 9,000 crore rupees, which is going to be a fresh issue. and 375 crores will be offered this proportion is actually very good because the company intends to use these funds primarily for its organic growth or inorganic growth plans.

And I always like to invest in companies that want to use my money for expansion rather than settling their loans, but let’s just, you know, dig deeper and look at the financials. So we’ll start with the balance sheet.

Now, Zomato definitely has a beautiful balance sheet. And the reason I say this is because Zomato has very little or no borrowings at all and that is a very positive point when it comes to the balance sheet. Now, the income statement is equally impressive after the growth of independents have been consistent in spite of some of the hiccups that they saw during the COVID crisis.

But for all of you considering investing, in Zomato Let’s understand a very simple fact first. So in spite of all the good things that we have talked about so far, Zomato is still a loss-making company.

Now that sounds bad. Right?

Why would anyone invest in a company which is loss-making? Well, there is a very good reason for investing in a company, even if it’s loss-making and a perfect example for that will be Reliance Jio remember how Mukesh Ambani stormed the telecom sector with ultra-cheap data plans and basically kicked most of the players out of the market.

And once these guys fell out of the market Jio, steadily, raise its prices. Right? So exactly the same game is being played by Zomato and Swiggy. Right, because they had to first establish themselves as minions in the sector and kick all that competition out. And now they’re, they’re in power. They have the ability to charge higher commissions and hopefully stay profitable for years and decades to come now with all that analysis now comes to the million-dollar question that will I be subscribing to this IPO?

So, guys, I like this company. I like that industry food delivery is here to stay. And in this market, Zomato has a sizable presence with strong brand recognition. And in fact, that even the average order value that Zomato has been receiving is on a rise, which is a very positive indication. So I would like to invest in this company.

Yes, but my main objection is the valuation. Zomato is not like a regular company where I can just use the profits to come up with a fair evaluation, the valuation of a company, which is in a pre-profit stage is done based on a lot of assumptions. And I’m not comfortable taking that leap of faith. The second thing is that I’m concerned about Amazon because we have seen in the past how damaging Amazon can be for the existing players in any sector.

So in the years to come, we don’t know how much damage can Amazon cost to Zomato. So to put it simply I’m willing to invest in Zomato but I’m willing to wait for it to get listed, even if I have to pay a premium, but I need some more clarity about the competition from Amazon. So, guys, this is it. I just wanted to share my understanding of the business of Zomato.

And I hope that you found something useful from this analysis.

Leave A Comment